You may recall that in 2011, the Chinese were playing games with the price of rare earth permanent magnets - they completely cut off Japan for awhile. The price of rare earth PMs sky rocketed. The whole world was rushing around wondering what to do.

The big question was on the availability and future price of rare earth magnets.

Other Company's Response. Some other companies that make motors bet that rare earth PMs would remain at sky high prices and they scrambled to develop alternative PMs, such as ceramic ferrite magnets. The problem is that ferrite magnets are not very powerful, their magnetic strength is about 1/3 that of a rare earth PM. So they had to make the magnets big and heavy to make up for their low magnetic strength, and that made their motors big and heavy too.

Zero E's Response. Back in 2011, Zero E’s board discussed this issue at some length: should we change our focus to ferrite or ceramic magnets? I counseled that we hold our course and suggested that the price of rare earths would soon fall. I cited a 1981 article in The Economist about the Club of Rome's report on the future availability of natural resources. I summarized one argument that The Economist had made as follows:

Our capitalist system over-reacts when there is a well publicized shortage and everyone can see that the price of some commodity is going to rise dramatically. All sorts of companies jump in and look for more supplies, for substitutes... so they can benefit from the coming windfall. And what usually happens? In several years there is a glut and the price collapses.

We bet that that the international publicity of the impending shortage and price rise would cause people to rush in and look for more deposits of rare earths (lots were found in Australia, Greenland, in the US, and on the pacific ocean seabed between Hawaii & Tahiti), that new processing mills would start up and old ones restart (e.g., Mount Weld in South Australia, Mountain Pass in California), and that other parties would look for substitutes (e.g., ceramic ferrite magnets). We were betting that the price of rare earths would collapse.

What Actually Happened?

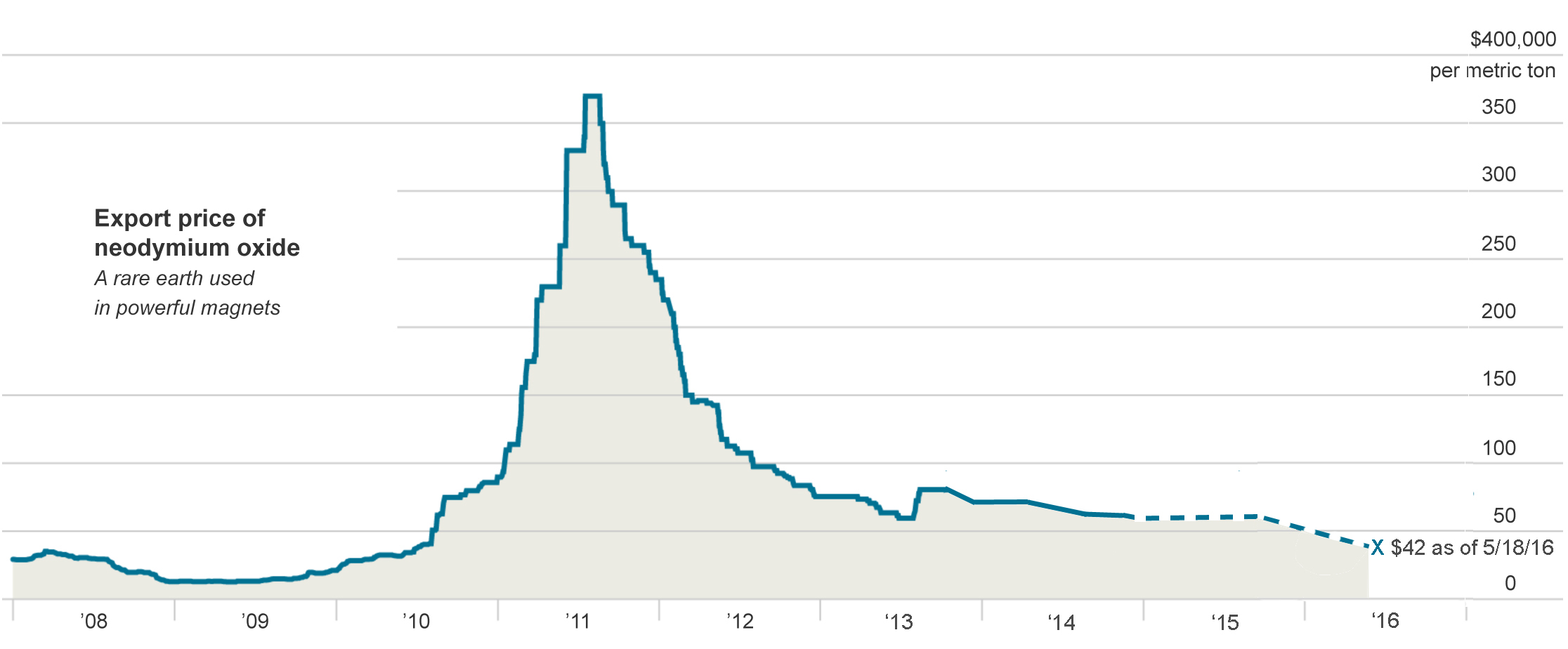

Below is a plot that shows what actually happened to the price of Neodymium Oxide, the key indicator of the price of rare earth PMs:

The price collapsed as we predicted. The price of rare earths today, is what it was back in 2008. In real terms, it is about 25% less.

Rare earths are not rare... they are everywhere and there is little reason to expect that the price will rise significantly any time in the near future. So much so that Molycorp - that had jumped in and brought the Mountain Pass mine in anticipation of high prices for rare earth PMs - found that the actual collapse in prices forced it into bankruptcy.

Zero E's ZEUS Motor uses rare earth PMs, and this is one reason for the ZEUS Motor's extraordinarily high efficiency, small physical size, and robustness. The cost of our PMs is less than 30% of the cost of the electromagnets used in our motor. The cost of our motor's PMs is not a significant factor in the pricing of our motor.